Best Practices For Amazon Sellers To Meet Chinese Shipping Rate Increases

- Aug 9, 2021

- 4 min read

Updated: Jan 12, 2023

While many of us may be fortunate enough to slowly be emerging from the pandemic, Amazon sellers are still facing some fairly dramatic repercussions—not least of which has been the ongoing supply chain crisis.

Shipping delays may have been commonplace over the past two years. But try explaining that to Amazon customers—a large number of whom don't just choose next-day express shipping options, but have come to expect it as an outright necessity.

The pandemic may have boosted both Amazon sales and eCommerce as a whole. But the aftereffects on shipping, delivery and production were something few sellers were prepared for.

Shipping, Consumer Goods and the Import Industry in China

According to a March 2021 survey commissioned by GEP, up to $4 Trillion globally may have been lost as a result of logistic providers and supply chains facing an increasingly fragile infrastructure unable to meet heightened consumer demands.

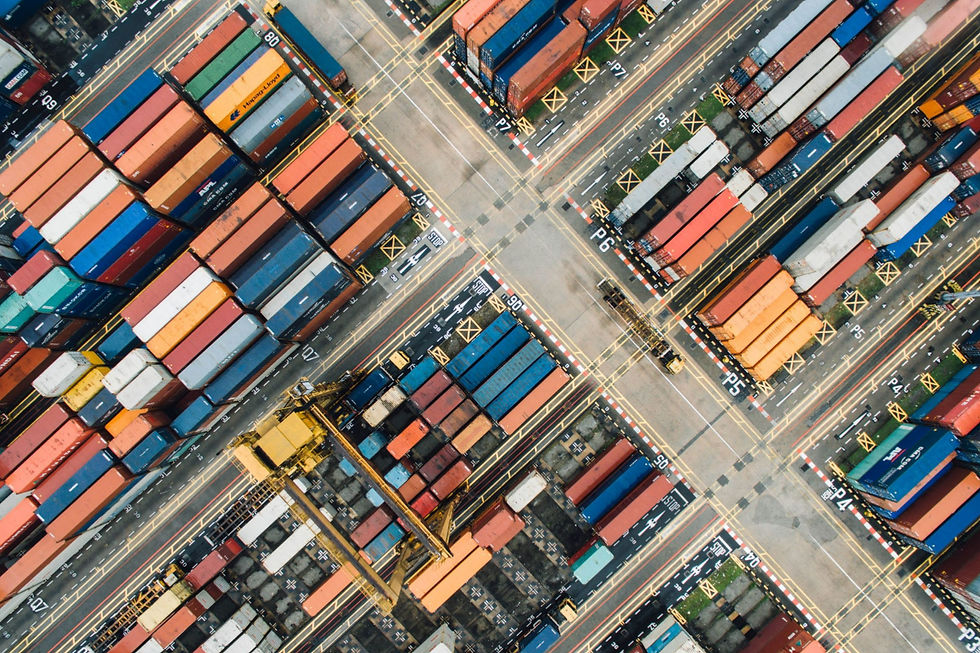

Domestically, supply chain disruption resulted in a marine port congestion which effectively paralyzed the three main terminals on both the east coast and the west coast; most notably, at the Port of Los Angeles, one of the busiest gateways for the import of Chinese goods.

That supply chain crisis has only been exacerbated by China's stringent pandemic regulations, which saw temporary cessation of outgoing orders at two separate ports in 2021 after reports of a COVID-19 outbreak among employees.

Yet global consumer demand for monthly Chinese imports reached a five year high of 300,000 container units in September 2020, culminating in a drastic shortage of availability.

While consumer purchases may have shifted from goods to services as inflation fears continue to mount, resulting in a 40 percent drop in Chinese orders during Q4 2022, container availability is still facing a critical shortage in a nation which is responsible for 30 percent of all global manufacturing output.

Container Availability and Freight Costs

The result has been a boon for private firms in China who had begun accumulating containers for resale at inflated prices, resulting in reports of freight rates in excess of $19,000 per 40 foot container as recently as July 2021.

But the exorbitant shipping rate increases have been a nightmare for both domestic and Chinese-based sellers on Amazon—the latter of whom represent an estimated 75 percent of new sellers in 2021.

Combined with the burden of elevated tariffs already in place on Chinese exports, Amazon sellers may be wondering how they can actually absorb the record level cost of shipping rates from China while still continuing to meet customer demands.

Unfortunately, there's no reassuring answer. The average cost of air freight shipping from China to the US was estimated at over $15 per kilogram in early December 2021; one of the highest rates ever recorded. While those freight rates decreased in 2022, the price of air freight shipping has historically been cost prohibitive for smaller Amazon sellers to meet.

Yet when news of ocean freight rates declining by 90 percent was reported in December of 2022, it wasn't necessarily a cause for celebration for many Amazon sellers.

eCommerce is largely based on a "Just in Time" business model, where both production and delivery is based on historic demand and sales volume. And Amazon is no different. A 2022 survey conducted by XDelivery and the Leavey School of Business found that over two thirds of consumers expect express shipping to be virtually mandatory—an incentive due in no small part to the popularity of Amazon.

Ocean freight costs may be considerably cheaper than air freight. But sea freight is also considerably slower, meaning even domestic manufacturers can't always rely on historic sales volume to meet customer demands.

While China continues to be the leader in global manufacturing, that status is being challenged by other APAC nations—most notably Vietnam, which witnessed nearly a 360 percent increase in cross-border manufacturing trade between 2014 and 2021.

Best Practices to Meet Chinese Shipping Rate Increases

Make certain your product line is guaranteed to sell

No matter how much of a price advantage buying in bulk from China may be, the ensuing cost of shipping isn't worth the overstock—particularly if you're an FBA seller. Taking the time to review at a SKU level which items are actually selling may prove time consuming. But it can mean the difference between 5 unsold units and 500.

Bundle imports with domestically manufactured products

While product bundling might seem like an art form, it's actually a fairly ingenious strategy which can help rotate slow-moving merchandise manufactured domestically.

Take careful notice of Amazon's product bundling guidelines, however. Amazon only permits items which are considered highly complementary to be included in a bundle (a consideration which can be an art form itself!)

Plan for the holidays as early as possible

Ordering for Prime Day from China two weeks ahead of time is a recipe for disaster. But ordering for Chinese New Year itself will prove next to impossible unless it's at least five months ahead of time (and for those of you keeping track, it will occur on February 1st in 2022.)

With everything to worry about during holiday planning, late shipments and increased fees should be the furthest thing from your mind.

Maximize your domestic product line

It might seem like a temporary solution. But until supply chain fragmentation becomes more manageable, it's a realistic one.

We've already seen many sellers leverage domestically manufactured products as part of their promotional strategy to no small degree of success as consumers are becoming aware of the issues surrounding shipping rates in China.

While we hope the crisis is short-lived, freeing up your cash flow is critical during the eCommerce upturn; and encouraging domestic shipping is the simplest way to achieve it.

Keep up to date with all the latest news impacting the world of eCommerce. Find out more atColor More Lines.

Comments